1. How AI and ML Can Enhance Fraud Detection and Prevention in Financial Institutions

Fraud detection and prevention is a critical component of financial institutions’ operations, as it helps protect customers from fraudulent activities and maintain the integrity of their services. Artificial intelligence (AI) and machine learning (ML) are two powerful technologies that can be used to improve the accuracy and efficiency of fraud detection and prevention in financial institutions. By leveraging these technologies, financial institutions can better detect suspicious activity, identify potential threats, and take proactive measures to prevent fraud.

2. Leveraging AI and ML for Improved Fraud Detection

AI and ML can help financial institutions detect fraud more quickly and accurately by analyzing large amounts of data and identifying patterns or anomalies that may indicate fraudulent behavior. For example, AI-powered systems can analyze customer transaction histories to detect unusual spending patterns or transactions that could signal fraud. Additionally, AI and ML can be used to monitor customer accounts for any changes in behavior that might suggest malicious intent. This allows financial institutions to proactively detect and respond to potential fraud before it occurs.

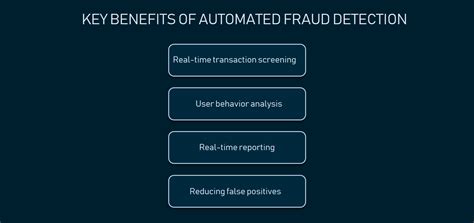

3. Enhancing Efficiency with Automation

AI and ML can also be used to automate certain aspects of fraud detection and prevention. Automated systems can scan customer accounts for suspicious activity and alert staff when they detect something out of the ordinary. This reduces the amount of manual labor required to investigate potential fraud cases, allowing financial institutions to focus on other tasks. Additionally, automated systems can be used to generate reports and provide insights into trends in fraud activity, helping financial institutions stay ahead of emerging threats.

4. Improving Security with Advanced Analytics

Advanced analytics tools powered by AI and ML can be used to uncover hidden relationships between different types of data, such as customer profiles, transaction histories, and account information. This enables financial institutions to gain deeper insights into customer behavior and identify potential risks more effectively. Additionally, advanced analytics can be used to develop predictive models that can anticipate future fraud attempts and allow financial institutions to take preventive measures accordingly.

5. Strengthening Compliance with Real-Time Monitoring

Real-time monitoring solutions powered by AI and ML can be used to ensure compliance with regulations and industry standards. These solutions can continuously monitor customer accounts and transactions for any suspicious activity, alerting financial institutions if anything appears out of the ordinary. This helps financial institutions remain compliant with regulatory requirements while also protecting customers from potential fraud.

6. Implementing Robust Risk Management Strategies

Robust risk management strategies are essential for preventing fraud and ensuring the security of customer data. AI and ML can be used to develop sophisticated risk management strategies that can identify potential threats and take appropriate action to mitigate them. For example, AI-powered systems can be used to detect anomalous behavior and automatically block suspicious transactions before they occur. This helps financial institutions reduce their exposure to fraud and protect their customers’ data.

7. Conclusion

AI and ML offer numerous benefits for fraud detection and prevention in financial institutions. By leveraging these technologies, financial institutions can detect suspicious activity more quickly and accurately, automate certain aspects of fraud detection and prevention, strengthen compliance with regulations, and implement robust risk management strategies. As AI and ML continue to evolve, financial institutions will have access to even more powerful tools for detecting and preventing fraud.